Community Infrastructure Levy Annual Report

June 2019

Contents

- Background

- Report for 2018/2019 Period

- Summary of all CIL monies

- Strategic CIL monies

- Appendix A: Developments CIL has been collected from

- Appendix B: Maps to show all the developments where CIL has been collected from since adoption

- Barnby Moor

- Bevercotes

- Blyth

- East Markham

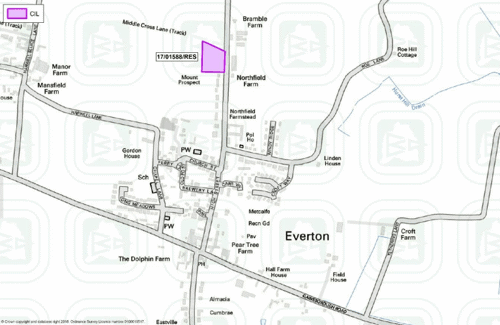

- Everton

- Harworth and Bircotes

- Langold

- Never Langwith

- Normanton-on-Trent

- North Leverton

- Rampton

- Ranskill

- Retford

- Rhodesia

- Shireoaks

- Sutton-cum-lound

- Walkeringham

- West Stockwith

- Worksop

- Appendix C: CO: Expenditure

- Appendix D: Local Infrastructure CIL Money

Background

The Community Infrastructure Levy (CIL) is a mechanism to allow local planning authorities to seek to raise funds from new development, in the form of a levy, in order to contribute to the cost of infrastructure projects that are, or will be, needed to support new development.

Following an examination of the Bassetlaw District Council Charging Schedule in November 2012, Bassetlaw District Council approved the implementation of its Community Infrastructure Levy from the 1st September 2013.

The CIL is intended to be used to help provide infrastructure to support the development of an area rather than making an individual planning application acceptable in planning terms (which is the purpose of Section 106 Agreements). CIL does not fully replace Section 106 Agreements.

On particular developments site specific mitigation requirements may still need to be provided through a Section 106 Agreement in addition to CIL. Section 106 Agreements and planning conditions will continue to be used for local infrastructure requirements on development sites, such as site specific local provision of open space, connection to utility services (as required by legislation), habitat protection, access roads and archaeology. The principle is that all eligible developments must pay towards CIL as well as any development specific requirement to be secured through Section 106 Agreements.

The provision of affordable housing lies outside the remit of CIL and continues to be secured through Section 106 Agreements.

A further amendment to the CIL Regulations in 2013 requires a ‘meaningful proportion’ of CIL receipts to be passed to the local town or parish council for the area where the development takes place (known as local infrastructure monies). The meaningful proportion to be passed to the local council is set at 15% of the relevant CIL receipts with a maximum cap of £100 per Council tax dwelling in the parish (with a further multiplier applied).

Where a Neighbourhood Plans is in place the ‘meaningful proportion’ will rise to 25% with no maximum cap specified. There are now thirteen Neighbourhood Development Plans that are in place:

- Carlton in Lindrick – adopted/made 21st February 2019

- Treswell and Cottam – adopted/made 21st February 2019

- Headon, Upton, Grove and Stokeham – adopted/made 6th September 2018

- East Markham - adopted/made 27th April 2018

- Sutton cum Lound – adopted/made 16th February 2018

- Bassetlaw CIL Annual Monitoring Report 2019 3

- Misson – adopted/ made 7th September 2017

- Clarborough and Welham – adopted/made 2nd February 2017

- Cuckney, Norton, Holbeck and Welbeck – adopted/made 9th March 2017

- Elkesley parish – adopted/made 12th November 2015

- Harworth & Bircotes parish – adopted/made 3rd December 2015

- Shireoaks parish – adopted/made 17th November 2016

- Sturton ward – adopted/made 11th February 2016

- Tuxford parish - adopted/made 10 November 2016

A Charging Authority is required under Regulation 62 of the Community Infrastructure Regulations 2010 (as amended) to prepare a report for any financial year in which it collects CIL. This is the sixth year which CIL has been collected in. For details on previous years, please see earlier reports.

Report for 2018/2019 Period

This table shows an overall summary of the transactions of CIL monies over the 2018/19 financial year. The full table of receipts for 2018/19 and monies invoiced in 2018/19 for are shown in Appendix A. The developments where CIL monies have been collected from since adoption is shown in Appendix B. The specific projects which CIL monies have been spent (i.e. expenditure) in 2018/19 is detailed in Appendix C.

- *1 - These are monies that have actually been received by the District Council and does not account for those that have been invoiced for and not paid yet.

- *2 - This figure has been updated to reflect previous years’ expenditure to cover the administrative expenses

- *3 - This figure includes any expenditure throughout the year including administrative fees

There has been no land or infrastructure given in kind during this financial year.

Strategic CIL monies

From the CIL monies collected, the majority of this is spent on strategic infrastructure identified on the Council’s regulation 123 list. The table below shows the breakdown of the money available for strategic infrastructure.

| Total CIL Monies (summary) 2018/19 | |

|---|---|

| Total CIL receipts for the reported year | £1,576,780.34 |

| Total CIL carried over from the previous year(s) | £1,623,239.83 |

| Total CIL expenditure for the reported year | £630,742.00 |

| Total CIL retained at the end of the reported year | £2,569,278.17 |

Local CIL monies

From the CIL monies collected, there is a meaningful proportion which should be spent on the area in which it was collected. The table below shows the breakdown of the money available for local infrastructure.

| Local CIL Monies (summary) 2018/19 | |

|---|---|

| Total CIL receipts for the reported year | £356,523.12 |

| Total CIL carried over from the previous year(s) | £325,948.49 |

| Total CIL expenditure for the reported year | £32,915.36 |

| Total CIL retained at the end of the reported year | £572,387.46 |

Once there are CIL monies paid from a local area where there is a parish or town council, the District Council’s preference is to pass this money to the parish/town council to spend the money. However, the District Council will also hold monies for local areas, or spent it on their behalf, at the request of the parish/town council. In Worksop and Retford, there a town council is not present, the District Council as charging authority will be responsible for spending this money on local infrastructure. For full details of the breakdown of these local monies, please see Appendix D.

Appendix A: Developments CIL has been collected from

| Planning Application references | Location | Invoices raised for CIL in 2018/19 | Outstanding CIL to be paid | Amount of CIL to be paid |

|---|---|---|---|---|

| 2018/2019 | ||||

| 16/01777/FUL | Retford | £835,904.00 | £208,976.00 | £626,928.00 |

| 15/00685/FUL | Bevercotes | £10,462.64 | £0.00 | £10,462.64 |

| 14/01619/FUL | Harworth | £2,999.46 | £0.00 | £2,999.46 |

| 15/00022/RSB | Worksop | £7,708.11 | £0.00 | £7,708.11 |

| 17/00033/RES | Worksop | £261,257.14 | £0.00 | £261,257.14 |

| 17/01588/RES | Everton | £109,832.51 | £82,374.38 | £27,458.13 |

| 18/00423/RES | East Markham | £16,745.23 | £16,745.23 | £0.00 |

| 18.00183/VOC | Worksop | £9,656.12 | £0.00 | £9,656.12 |

| 14/00987/FUL | Worksop | £709,922.14 | £704,922.14 | £5,000.00 |

| 14/01622/FUL | Langold | £18,046.05 | £0.00 | £18,046.05 |

| 18/00612/RSB | Normanton on Trent | £10,896.29 | £0.00 | £10,896.29 |

| 18/00445/RES | Rhodesia | £20,577.86 | £15,433.40 | £5,144.46 |

| 17/01047/FUL | Worksop | £7,920.00 | £5,940.00 | £1,980.00 |

| 17/01486/FUL | West Stockwith | £9,618.72 | £9,618.72 | £0.00 |

| 17/00603/FUL | Rampton | £9,796.54 | £7,347.40 | £2,449.14 |

| 17/01529/FUL | Blyth | £174,183.43 | £130,637.57 | £43,545.86 |

| 18/00589/VOC | Blyth | £70,151.79 | £0.00 | £70,151.79 |

| 15/01070/FUL | Retford | £12,071.40 | £0.00 | £12,071.40 |

| 18/00127/RES | Barnby Moor | £9,091.78 | £9,091.78 | £0.00 |

| 18/00648/RES | Shireoaks | £241,563.43 | £181,172.57 | £60,390.86 |

| 18/00408/FUL | Retford | £63,697.82 | £47,773.36 | £15,924.46 |

| 15/01321/FUL | Nether Langwith | £9,379.32 | £7,034.49 | £2,344.83 |

| 18/01085/FUL | Worksop | £354.57 | £0.00 | £354.57 |

| 15/00878/COU | Retford | £34,238.64 | £0.00 | £34,238.64 |

| 18/01232/RSB | Sutton cum Lound | £42,313.86 | £31,735.40 | £10,578.46 |

| 15/00634/FUL | North Leverton | £3,686.49 | £0.00 | £3,686.49 |

| 15/01266/FUL | Walkeringham | £45,620.45 | £0.00 | £45,620.45 |

| 17/01723/RES | Barnby Moor | £6,837.20 | £0.00 | £6,837.20 |

| 17/01723/RES | Barnby Moor | £7,430.37 | £0.00 | £7,430.37 |

| 17/01172/RES | Sutton cum Lound | £101,873.32 | £101,873.32 | £0.00 |

| 17/01291/FUL | Ranskill | £18,632.59 | £0.00 | £18,632.59 |

| 18/00199/FUL | Worksop | £4,961.25 | £0.00 | £4,961.25 |

| 18/01095/FUL | Harworth | £4,961.25 | £0.00 | £4,961.25 |

| 18/01591/NMA | Shireoaks | £1,825.71 | £1,825.71 | £0.00 |

| 18/01181/FUL | Langold | £10,490.32 | £0.00 | £10,490.32 |

| 17/01046/RES | Worksop | £2,536.97 | £0.00 | £2,536.97 |

| 16/00279/FUL | Retford | £3,825.91 | £0.00 | £3,825.91 |

| 17/00777/FUL | Carlton in Lindrick | £0.00 | £1112.59 | |

| 17/00271/RES | Shireoaks | £145.125.00 | £435,375.00 | |

| 16/01678/FUL | Retford | £0.00 | £10,389.42 | |

| 14/01269/FUL | Retford | £0.00 | £9,527.72 | |

| 17/00939/FUL | Ranskill | £0.00 | £16,246.70 | |

| 13/00471/RENU | Worksop | £0.00 | £8,741.66 | |

| 17/00897/NMA | Worksop | £0.00 | £3,648.64 | |

| 13/01347/VOC | Rampton | £0.00 | £2,725.89 | |

| 16/00861/FUL | Harworth | £0.00 | £1,302.49 | |

| 15/01584/FUL | Worksop | £0.00 | £8,423.61 | |

| 16/01487/RES | Worksop | £177,231.56 | £177,231.57 | |

| 15/00416/FUL | Beckingham | £0.00 | £5,000.00 | |

| Total | £2,910,734.14 | £1,889,482.74 | £2,035,056.28 | |

Appendix B: Maps to show all the developments where CIL has been collected from since adoption

CIL Map: Barnby Moor

CIL Map: Bevercotes

CIL Map: Blyth

CIL Map: East Markham

CIL Map: Everton

CIL Map: Harworth and Bircotes

CIL Map: Langold

CIL Map: Nether Langwith

CIL Map: Normanton-on-Trent

CIL Map: North Leverton

CIL Map: Rampton

CIL Map: Ranskill

CIL Map: Retford

CIL Map: Rhodesia

CIL Map: Shireoaks

CIL Map: Sutton-cum-Lound

CIL Map: Walkeringham

CIL Map: West Stockwith

CIL Map: Worksop

Appendix C: CIL Expenditure

The table below shows the amount of CIL expenditure in 2018/19 for strategic infrastructure:

| Type of infrastructure | Description of infrastructure provided | Location of infrastructure provided | Cost of infrastructure | Date spent |

|---|---|---|---|---|

| Strategic infrastructure | A57/Shireoaks Common roundabout at Worksop | Design work for the improvement scheme | £20,000 |

August 2018 |

| A57/Shireoaks Common roundabout at Worksop | Planned improvement to roundabout | £630,742.00 |

August 2018 |

|

| Total | £650,742.00 |

The table below shows the amount of CIL expenditure in 2018/19 for local infrastructure:

| Type of infrastructure | Description of infrastructure provided | Location of infrastructure provided | Cost of infrastructure | Date spent |

|---|---|---|---|---|

| Strategic infrastructure | Local money transferred to Parish Council | Beckingham | £1374.63 |

Transferred in Dec 2018 |

| Local money transferred to Parish Council | East Markham | £2071.62 |

Transferred in Dec 2018 |

|

| Local money transferred to Parish Council | Harworth and Bircotes | £6118.18 | Transferred in Sep 2018 | |

| Local money transferred to Parish Council | Rampton | £5657.86 | Transferred in Sep 2018 | |

| Local money transferred to Parish Council | Ranskill | £17,693.07 | Transferred in Oct 2018 | |

| Total | £32,915.36 |

Appendix D: Local Infrastructure CIL Money

The table below shows the CIL local infrastructure monies received in the five previous financial years for each of the parish/town areas.

| Parish Town Council Area | 2013/2014 | 2014/2015 | 2015/2016 | 2016/2017 | 2017/2018 | 2018/2019 | Subtotal | Monies transferred in 2017/18 | Monies transferred in 2018/19 | Final total of funds available |

|---|---|---|---|---|---|---|---|---|---|---|

| Barnby Moor | £790.74 | £2,140.14 | £2,930.88 | £2,930.88 | ||||||

| Beckingham | £1,374.63 | £1,758.45 | £3,133.08 | £1,374.63 | £1,758.45 | |||||

| Bevercotes | £1,569.40 | £1,569.40 | ||||||||

| Blyth | £1,376.60 | £17,054.65 | £18,431.25 | £1,376.60 | £17,054.65 | |||||

| Carlton-in-Lindrick | £582.11 | £55.63 | £166.89 | £804.62 | £804.62 | |||||

| East Markham | £28,092.40 | £2,071.62 | £30,164.02 | £28,092.40 | £2,071.62 | NIL | ||||

| Everton | £1,595.37 | £6,671.26 | £4,118.72 | £12,285.35 | £12,385.35 | |||||

| Harworth and Bircotes | £1,826.01 | £8,459.67 | £31,480.79 | £6,118.18 | £2,025.54 | £49,910.19 | £41,766.47 | £6118.18 | £2,025.54 | |

| Langold | £4,280.46 | £4,280.46 | £4,280.46 | |||||||

| Marnham | 983.46 | £983.46 | £983.46 | NIL | ||||||

| Mattersey | £1,761.90 | £880.67 | £2,642.57 | £1,761.90 | £880.67 | |||||

| Nether Langwith | £351.72 | £351.72 | £351.71 | |||||||

| Normanton-on-Trent | £1,594.31 | £1,634.44 | £3,228.76 | £1,594.31 | £1,634.44 | |||||

| North Leverton | £552.97 | £552.97 | £552.97 | |||||||

| Rampton | £5,657.86 | £776.25 | £6,434.11 | £5,657.86 | £776.25 | |||||

| Ranskill | £664.94 | £17,693.07 | £23,589.91 | £664.94 | £17.693.07 | £5,231.90 | ||||

| Retford | £871.91 | £32,577.78 | £38,659.62 | £10,770.94 | £106,935.83 | £189,816.09 | £189,816.09 | |||

| Rhodesia | £1,591.44 | £1,974.23 | £771.67 | £4,337.34 | £123,941.47 | |||||

| Shireoaks | £123,941.47 | £123,941.47 | £123,941.47 | |||||||

| Styrrup and Oldcotes | £295.76 | £31,363.99 | £31,659.75 | £295.76 | £31,363.99 | |||||

| Sutton cum Lound | £2,644.62 | £2,644.62 | £2,644.62 | |||||||

| Torworth | £2,692.14 | £2,692.14 | £2,692.14 | |||||||

| Treswell | £362.77 | £362.77 | £362.77 | |||||||

| Tuxford | £104.20 | £528.75 | £671.11 | £1,304.06 | £632.95 | £671.11 | ||||

| Walkeringham | £6,843.07 | £6,843.07 | £6,843.07 | |||||||

| Worksop | £774.00 | £13,438.99 | £2,011.24 | £7,429.37 | £60,099.01 | £73,724.95 | £157,477.55 | £157,477.55 | ||

| Total | £774.00 | £17,898.81 | £48,670.91 | £145,941.17 | £112,663.58 | £356,523.12 | £682,471.61 | £77,168.79 | £32,915.36 | £572,387.46 |

Last Updated on Monday, September 30, 2024