Bassetlaw District Councillors have agreed the Council’s budget for the next financial year at a meeting of full Council on Thursday 7th March, including setting the amount of Council Tax it will collect over the next 12 months.

Despite facing increased pressures, the Council has set a balanced budget for the year ahead with a total spend of £50 million over the next 12 months that will fund vital services such as Waste and Recycling collection, Planning, Environmental Health and enforcement, Parks, Cemeteries, Economic Development and Community Safety.

This also includes investment in the district’s town centres, funding rural community projects, supporting Bassetlaw businesses, and funding for third sector organisations such as Citizens Advice, Bassetlaw Action Centre and BCVS.

The Council’s budget is funded by a combination of Government grants, fees and charges for Council services, and other income, with the balance of around £21 million provided by the Local Government Finance Settlement which includes other Central Government funding, Business Rates and Bassetlaw’s portion of Council Tax.

The Council’s spending has increased by around £3 million from 2023/24, mainly due to the increased cost of utilities, inflation and increasing demand on the Council’s services.

An independent special interest group, SIGOMA, has also revealed that Bassetlaw District Council receives £9.6m less in Government funding than it did in 2010/11. This equates to a 39% reduction in the money it receives from central Government since 2010/11.

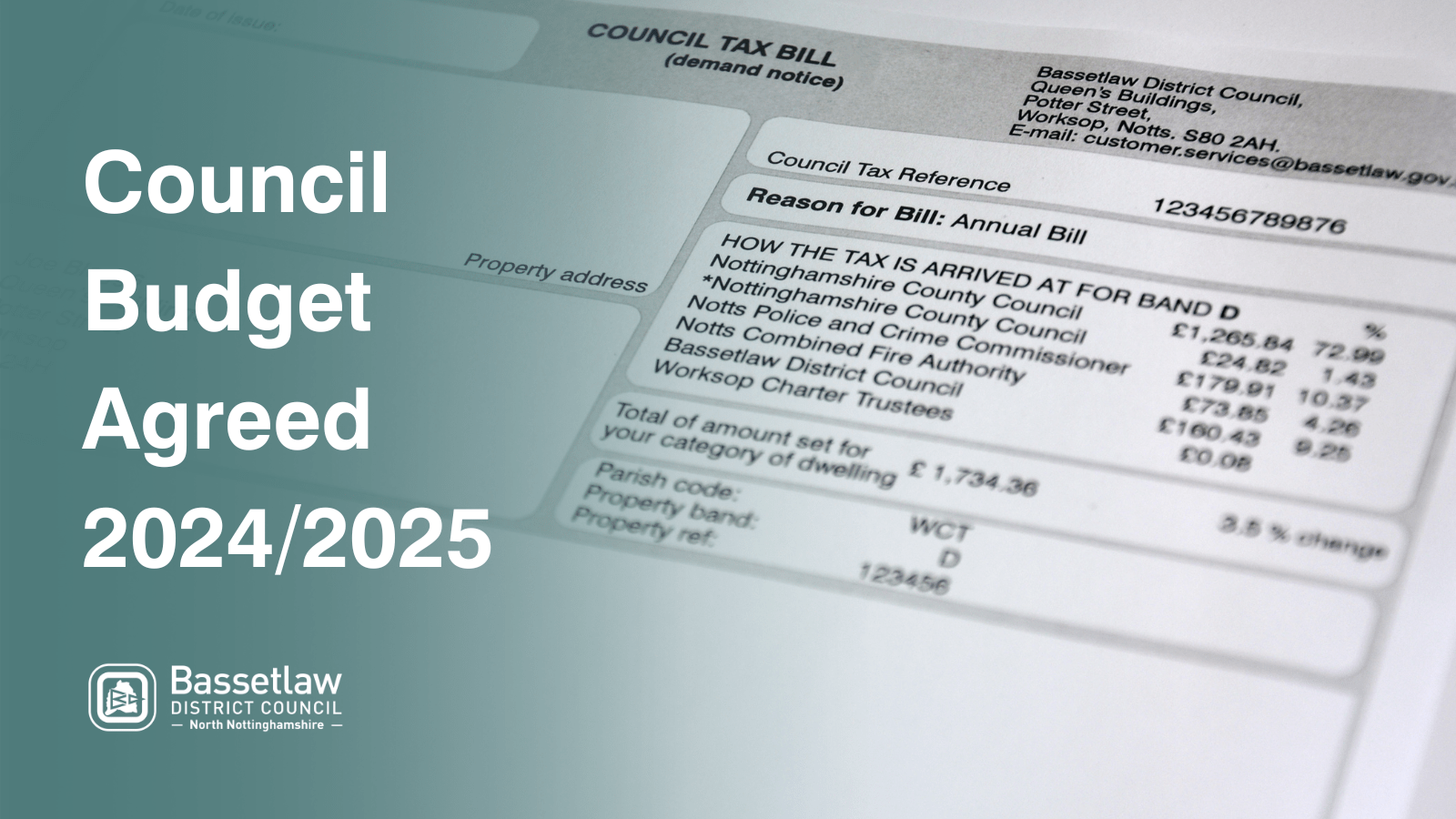

In order to secure the Council’s finances and fund public services, the Council is raising its share of the Council Tax bill by 2.99% for the coming year from 1st April 2024.

For Band D properties, this will mean an increase of £5.80, or approx. 11p per week. However, around half of Bassetlaw properties are in Band A and they will see an increase of approx. £3.87 spread over the course of the next 12 months, the equivalent of 7p per week.

Cllr Alan Rhodes, Cabinet Member for Corporate and Financial Services said:

“We know this is yet another financial ask of residents, but it’s one we must make. The council has a statutory responsibility to set a balanced budget and it is a challenge and dilemma that councils around the country are facing.

“We continue to provide good services within budget, whilst working towards bold ambitions for Bassetlaw. We have done this by protecting front-line services and working with partners to provide better and more cost-effective solutions and finding sustainable savings.

“We will continue with our aim to protect and enhance key services for residents whilst making our organisation financially sustainable for the medium to long term.”

The portion of Council Tax that Bassetlaw receives, just 8.25%, is used to provide essential and statutory services from bin collections, recycling, housing, planning, environmental health, licensing and much more.

The Council’s increased element of Council Tax is made alongside increases in other major preceptors (based on a Band D property). These include:

Nottinghamshire County Council – 4.84% including a social care precept at 2%

Nottinghamshire Police and Crime Commissioner – 4.81%

Nottinghamshire Fire and Rescue Authority – 2.95%

Parish Councils and Charter Trustees have increased – 4.72% (on average)

These changes result in an overall increase for a Band D property of 4.61%

Your Council Tax is distributed in the following ways:

Nottinghamshire County Council – 74.56% (including Adult Social Care)

Nottinghamshire Police – 11.64%

Bassetlaw District Council – 8.25%

Nottinghamshire Fire & Rescue Service - 3.80%

Parish Councils - 1.75%

Last Updated on Wednesday, May 8, 2024